🎧 Spotify's $100B Quest to dominate Audio

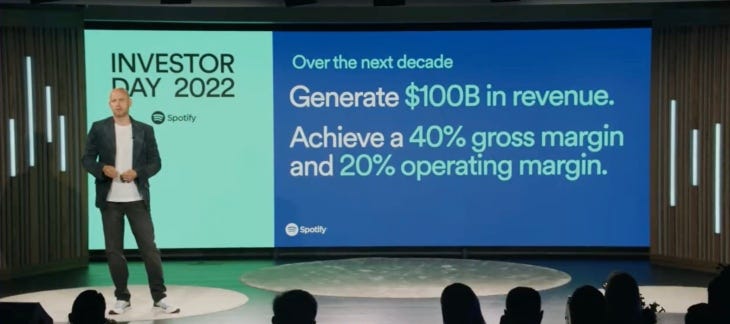

Yesterday, Spotify CEO Daniel Ek outlined the company's bold vision to target $100B in revenue for this decade, and dominate the consumer audio industry

We write a weekly newsletter on all things Music, and the Business and Tech behind it. If you’d like to get it directly in your inbox, subscribe now!

Happy weekend everyone!

Even if you do not take the slightest interest in the stock market or the financial world in general, it wouldn’t come across as a big surprise to you that investors around the world are reeling in from one of the biggest crashes global markets have seen in over a century.

Over the past 6 months, stocks around the world have fallen across sectors, but especially in Tech, with the NASDAQ- an index tracking 3700+ companies focused mainly on Technology companies, shedding almost 25% of its value 📉

Companies like Coinbase, Zoom, Netflix and Spotify, whose stock prices soared in the pandemic owing to a massive growth in its user base, and had a lot of capital heading their way from investors, now see themselves down almost 60-70% off their 2021 year-end highs.

With Central Banks raising interest rates in 2022, in an effort to fight inflation, which has become staggeringly high across countries, it seems like the party is over for the majority of these ‘Pandemic Darling’ stocks.

Spotify in particular has had a tough 2022, notwithstanding its 54% drop in stock price since the start of the year, but with additional controversy around the Joe Rogan & Neil Young vaccine controversy- something we covered previously 👇🏻

So when the entire leadership team of Spotify lined up in its New York City offices earlier this week for their Investor Day presentation, it was interesting to see how the world’s largest music streaming & audio platform was planning to tackle what would be an interesting next decade for Spotify.

Did you make it this far? It seems like you’re digging our content!

Help us grow by sharing this newsletter 👇🏻

Doubling down on Podcasts 🎙

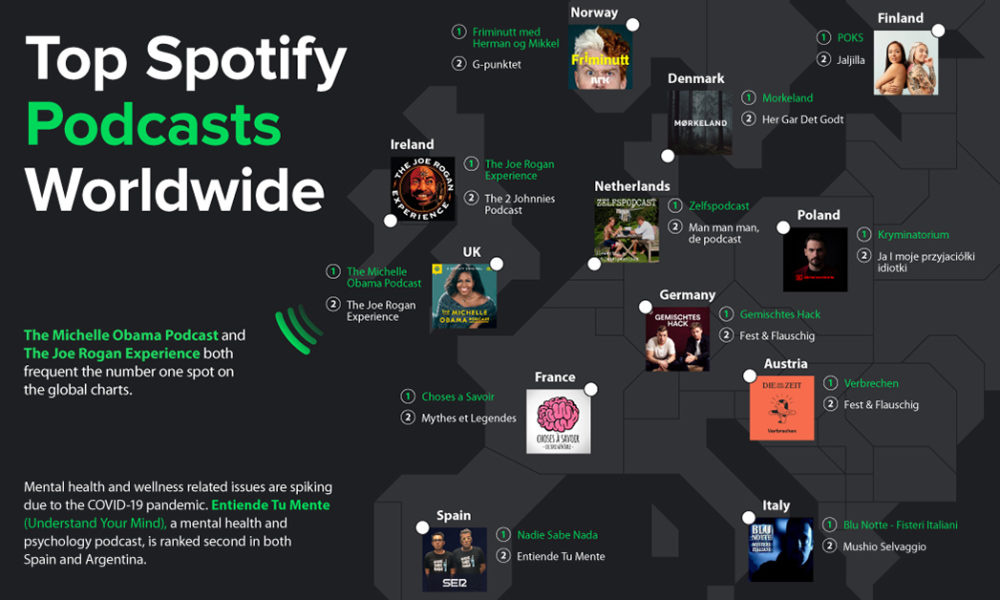

Spotify spent a good portion of its presentation specifically focused on podcasts, which had largely been unchanged for years before its entry into the market, due to the limitations of RSS- the tool that lets podcasters publish their episodes to multiple platforms such as Apple Podcasts, Spotify, Google Podcasts, etc.

Unbundling podcasts from RSS technology has paved the way for Spotify to generate revenue through these popular audio programs, which previously only relied on advertisements within their shows to make money 💸

Spotify has disrupted that market by bringing some podcasts in-house- such as “Joe Rogan Experience”, where they can only be heard on its service, and the company told investors it’s now offering podcast subscriptions (basically, paid podcasts), across 34 markets.

Its on-platform subscriber retention rate for these is 90% since its 2021 launch, and it has partnered with over 100 publishers and platforms on subscriptions to date and is expanding.

The company also highlighted the growth of podcasts on its service, noting that Spotify today has over 4 million podcasts, up from 500,000 in 2019 🚀

Podcast creation tool Anchor has helped contribute to this growth, saying that the app powers 75% of the podcasts on Spotify, and each new show created on Anchor brings in an additional 2.5 Million monthly active users to the service.

But beyond the sheer number of available shows, Spotify highlighted the revenue-generating potential of its investments in this medium — investments which are over $1 billion when considering its acquisitions of tools, ad tech and studios, as well as internal development efforts.

Apart from Podcasts, another newer area of non-music-related audio investment outside podcasts could then follow, Spotify said, speaking to its more recent entry into the audiobook market, now led by other service providers, like Apple, Audible (Amazon), Google, Scribd, Audiobooks.com and others.

Spotify CEO Daniel Ek said:

“Today, the global size of the book market is estimated to be around $140 billion dollars. That’s inclusive of printed books, e-books and audiobooks, with audiobooks having only about a 6%-7% market share.

But when you look at the most penetrated audiobook markets, it’s actually closer to 50% of the market. So call that an annual opportunity of $70 billion dollars for us to expand and eventually compete for”

Where does Music come into play here?

While it is no secret that the complicated structure of the music industry, means that the value created by streaming platforms by providing 60 Million+ songs for unlimited streaming, and the value captured by charging a flat $9.99/month fee to consumers is way off, Ek had interesting thoughts on the pricing strategy of Spotify as well.

“We definitely think that there’s pricing power with this model [and] the more things we’re bringing on to the platform, the more value we’re bringing to users, which of course should mean that we have more opportunity to raise prices over time.

It’s absolutely part of our strategy. That said, we’re in a macro environment which is very uncertain at this time.”

So while Spotify did increase prices in certain geographies like Brazil, Argentina & Sweden, it isn’t yet ready to spook consumers by raising prices across the world.

Our take on this?

Spotify seems to be pulling the classic bait-and-switch on the music industry, even though it might not admit so 🎣

Having ridden the wave of becoming the biggest music streaming platform in the past decade, Spotify also built its reputation as one of the most desirable Tech companies to work at, scaling at a breakneck pace, without much attention to the bottomline 💰

However, being a publicly listed company comes with its own challenges, and returning value to its shareholders is something Spotify is waking upto now, and targets Podcasts & Audiobooks to help it generate greater margins, as the same does not have a royalty structure attached to it like music does.

With competition coming from Apple, Amazon and YouTube, all 3 of which have significantly higher cash reserves to spend on product and marketing, it seems like an uphill battle for Spotify to compete this decade.

What do you guys think? Do you use Spotify for both music and podcasts, if at all?

Sound off in the comments! Have a good weekend folks 🍻

If you liked this newsletter from Incentify, why not share it with someone you like?

P.S- Follow us on Instagram and Twitter for more such content on all things Music and Culture, now!