The $4 Billion Universal Bet

Billionaire investor Bill Ackman is reportedly close to a SPAC deal to buy 10% of Universal Music Group at a valuation of roughly $40 Billion

We write a daily newsletter on all things Music, and the Business and Tech behind it. If you’d like to get it directly in your inbox, subscribe now!

What’s good everyone?

What was once stagnant for almost two decades, the music publishing business has bounced back with a bang.

The rise of streaming platforms like Spotify and Apple Music, coupled with increased revenues for publishers and artists, means that investors are looking at music favorably again- something we have covered in previous newsletters.

Universal Music, the largest publisher of music in the world, might now be listed on public stock markets through a SPAC deal with billionaire investor Bill Ackman’s, Pershing Square Tontine Holdings (PSTH).

But who is this guy?

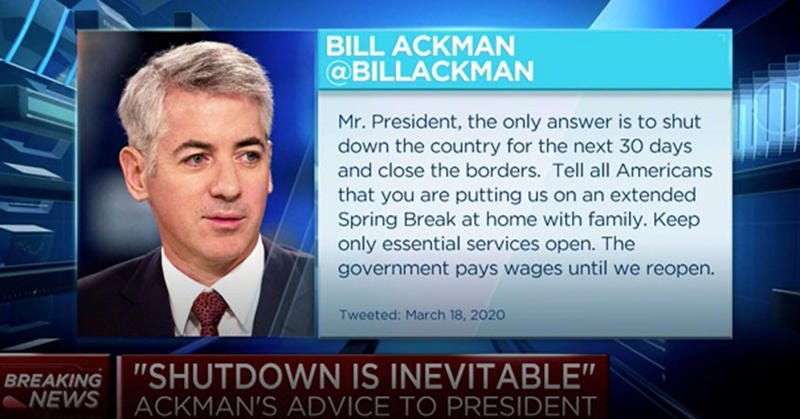

Ackman is an American investor and CEO of Pershing Square Capital Management, a hedge fund management company, who gained attention for his successful yet controversial call last year, off the back of betting against the stock market owing to the rising concerns of Coronavirus in late February and March. What was in it for Ackman and his hedge fund?

Ackman turned $26 Million into $2.6 Billion just off the back of this bet 🤯

So having minted money with his contrarian calls last year, why is he looking to get a slice of the pie when it comes to Universal Music? Let’s get into it 👇🏻

Universal Music Group or UMG is the owner of renowned labels including Capitol Music Group, Def Jam Recordings, Island, and its own brands, among others. It houses artists like Taylor Swift, Lady Gaga, Kanye West, The Weeknd, Billie Eilish, Rihanna, and many other big names.

It is also looking to aggressively go after buying song catalogs of other legendary artists and recently splashed out $300 Million for the entire song catalog of Bob Dylan.

While that might sound exciting, UMG also has numbers to back up its aggressive growth plans.

In the first quarter of 2021, its revenues rose by 9% and UMG generated €1.8 billion, and Earnings before Interest and Taxes of €322 million, a 35.8% increase.

Watching this revival of the music industry unfold, Bill Ackman’s SPAC Pershing Square Tontine Holdings is likely to finish the transaction by 22nd June and get a piece of that action.

French media company Vivendi, the majority owner of Universal Music controlling 80%, is set to hold its shareholder meeting on that day, and Vivendi confirmed on Friday that it was in talks with Ackman’s hedge fund to take it public in a deal that would value Universal at more than $40 billion.

If you made it this far, seems like you’re fancying our content! Why not share it and support us?

But what is a SPAC?

SPACs are empty shell companies that raise money with the sole purpose of looking for a target to merge with and bring public and have exploded in popularity as companies seek alternatives to a traditional IPO.

So far in 2021, at least 330 SPACs have raised $104 billion, blowing through last year’s record of more than $80 billion. They typically have two years to find a target.

Enthusiasm for SPACs has faded recently among investors, as some of the highest-profile deals haven’t met lofty financial targets, and regulators have been increasing scrutiny on the transactions.

Does this mean that this deal combines the two entities? Strangely no.

As part of the unusual plans, Vivendi still aims to distribute other remaining Universal shares to investors through a public listing on the Euronext- the Amsterdam-based stock exchange later this year.

The SPAC listing is viewed as a proxy to value Universal Music ahead of this public distribution. The transaction, a first of its kind for a SPAC, would not combine the two companies. Instead, Ackman’s hedge fund would distribute Universal shares directly to shareholders.

How has the market reacted to this news? Not good so far.

Pershing suffered its worst stock decline since September after announcing the deal that perplexed investors and analysts. The shares fell as much as 15% in New York and closed at $22.06. While that’s still above its listing price of $20, it’s far below the high of almost $33 hit earlier this year.

Our take on this?

We have written on how royalties from music have proven to become an invaluable asset over the years, with consistent and predictable cash flow returns. With Ackman’s hedge fund having its backs against the wall to get a deal closed for the SPAC, it’s going to be interesting to see how this one unfolds.

One thing is for sure, investors are lapping up to the music industry in numbers never seen before, but will that translate into better earnings for artists?

Only time will tell.

If you liked this newsletter from Incentify, why not share it with someone you like? Let’s build the community :)

P.S- Follow us on Twitter and Instagram for more such content now!