The Birth of the Next Netflix?

This week, American Telecom Giant AT&T announced that they were selling off their media division to Discovery +, potentially giving birth to a streaming giant.

We write a daily newsletter on all things Music, and the Business and Tech behind it. If you’d like to get it directly in your inbox, subscribe now!

Happy weekend everyone!

It has been a crazy week in the world of Music and Entertainment, with a bunch of mergers and acquisitions announced.

Amazon is reportedly planning to buy MGM studios for $9 Billion, and beef up its content library of Amazon Prime Video, by adding MGM classics such as the James Bond and Rocky series of films.

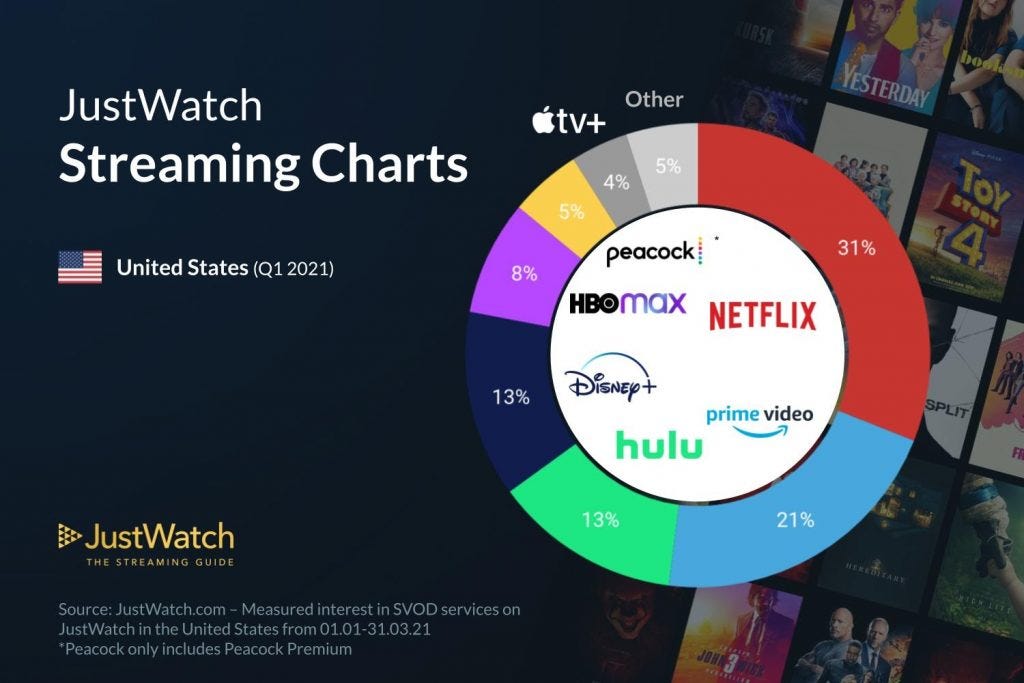

With the race to acquire users heating up between Netflix, Amazon, and Disney: the De-Facto top 3 in the media streaming business, companies such as MGM which are analog players in a digital world, are looking to cash out and leverage their copyrights over classic franchisees.

However, the biggest news of the week came with announcements over American telecom giant AT&T looking to exit the media business after an unsuccessful bet in 2016 of purchasing the famed Warner Media for $85 Billion and debt and having to fight a lengthy battle against the government to acquire the studio.

So after pouring in billions of dollars into building Warner Media and its assets such as HBO and CNN, why is AT&T looking to exit now?

It is going back to basics.

AT&T CEO John Stankey told investors during a call on Monday after the deal to sell the Time Warner assets was announced:

"Our goals with the new AT&T are simple and straightforward, We plan to continue the momentum in our mobility business by stepping up our investment in our wireless network.”

With the battle for 5G data services amongst the 3 telecom giants of Verizon, T-Mobile, and AT&T heating up, movies and entertainment was just an unnecessary distraction for the Texas-based $270 Billion giant.

So how does this deal work?

The merger will fuse the Warner Media assets of AT&T with Discovery. It will spin off into a publicly-traded company that is yet to be named and led by the CEO of Discovery, David Zaslav.

But why Discovery? Good leadership.

Zaslav is an industry veteran, having spent the first two decades of his career at NBC, where he helped launch CNBC before taking the helm at Discovery in 2007. He took Discovery public, turned it into a reality television leader with shows such as The Oprah Winfrey Show, Man vs Wild, and Pawn Stars, then brought it back to its documentary and science-oriented roots broadcast on Discovery Channel and Animal Planet.

He made it a live sports destination with the acquisition of Eurosport and a multi-year deal to provide coverage of the Olympics in international markets. During his tenure, Discovery’s profits have more than doubled, and it reached a market cap of $16 Billion.

However, Zaslav was slow to take to streaming, even as competitors launched services and cable subscriptions dwindled. Discovery launched its streaming bid, Discovery Plus, only in January. It claims to have surpassed 15 million paying subscribers in April.

Knowing that Discovery was late to the game, with Netflix already amassing 200 Million paid subscribers, Zaslav is looking to fix that with this merger of Warner Media.

While talking to investors in a conference call, Zaslav said:

“You gotta have content people love so much they would run home and pay for it before they pay for dinner or a roof over their head”

Clearly, Discovery wants a piece of the streaming action and acquiring the IP of Warner Media, which has some of the most mouth-watering production assets in the media world, including Warner Movies, Warner TV Studios, HBO and CNN mean that this merger has the potential to become the next big streaming platform.

Confused?

Think of Lord of the Rings, Harry Potter, Batman, the Matrix, you name it, all the biggest movies in Hollywood are practically produced by Warner Media.

When it comes to TV shows, think of the entire HBO collection- Game of Thrones, The Sopranos, Entourage, Friends, Curb Your Enthusiasm, Sex and the City, and countless other classics, all under one umbrella.

The merger will ensure that AT&T receives $43 billion in a combination of cash, debt securities, and Warner Media’s retention of certain debt. Also, AT&T shareholders will hold 71% of the new company while Discovery stockholders will own 29% of the conglomerate.

Zaslav stated that the combined entities have thrown an additional $20 billion into the mix just for content, which is $3 billion more than the streaming giant Netflix which reportedly has used $17 billion dollars for their content budget in 2021.

As things stand, Netflix remains the market leader with 200 million subscribers, followed by Amazon Prime Video and Disney + and Hulu, both at 100 million subscribers each.

So how will this merger improve the situation for AT&T and Discovery?

With all that money in their arsenal for content, they plan to take Netflix, Disney, and Amazon head-on.

Warner Media is still one of the biggest production houses in the world, and despite being a victim of poor leadership, with their CEO Jason Kilar being pushed out of the new company for a series of unpopular decisions such as releasing big-ticket movies such as Godzilla vs Kong and Dune simultaneously on HBO Max and in theatres, something which ends up hurting Box Office revenues, Warner remains an invaluable media asset, especially with HBO in its kitty.

However, it is unclear what the company plans for their streaming service as the leaders have declined to give insights into the long-term plans they have for HBO Max- which has 44 million subscribers and Discovery+. And out of the combined $20 billion thrown in the mix, it remains unclear how much of that will be used for streaming platforms.

This means the future remains uncertain for the media properties owned by the companies. This deal could end up combining HBO Max and Discovery+ or they might retain their status as individual streaming services.

Our take on this?

While it’s really tough to break the market captured by Netflix, where it’s synonymous with streaming, Warner has some insane media assets in its kitty and a talented pool of studios under it, credited with creating some of the greatest films and TV Shows of all time.

It’s going to be an interesting battle between Big Tech and Legacy institutions, something which seems to be a recurring theme in most industries around the world.

If you liked this newsletter from Incentify, why not share it with someone you like?

P.S- Follow us on Twitter now!